How much does Portugal’s property cost?

The average residential property cost in Portugal is €2,500 per 1 m², according to idealista.com. Official statistics on the price per square meter is not provided. The National Statistics Institute, or INE, provides data on the banks’ appraisal of estimated mortgage collateral value per square meter. Still, that estimate is lower than the commercial value.

According to INE data, an average apartment or house in Portugal costs €190,000. Foreign buyers spend more: €406,000 per property on average.

The higher purchase prices for foreigners are explained by Portugal residence permit by investment program, or Golden Visa. Participants must buy a property worth at least €280,000 per its terms. The Golden Visa Program was suspended in April 2023, and is set for a reboot with no property investment options. Still, future participants will be able to invest in Portugal's cultural heritage, scientific projects, business, company creation, or investment fund shares. The minimum threshold will be €250,000.

Foreigners who want to get a residence permit by investment in real estate can use an alternative: the Portugal D7 visa.

New buildings are 1.5 times more expensive than the secondary market ones. Portugal builds mostly large apartments and houses: 60% of new properties have 3 or more bedrooms.

Half of Portugal’s population lives in apartments, and the other half — in houses. In cities, most people live in apartments: namely, 9 out of 10 residents in Lisbon, Porto, and Braga. One-fifth of the population rents housing, while the rest live in homes and apartments.

The cost of residential real estate in Portugal has doubled over 7 years since 2015. Prices have been growing by 1.5—12% per year; in 2019, the annual increase became 10%.

The average annual rental yield is 5.5% of the cost property cost. Rental prices in Portugal have been growing, setting a 3-year record of €13 per 1 m² in 2022. At the same time, the rental yield decreased during the same period due to the outstripping cost growth of real estate.

Property buyers from abroad can obtain a Portugal residence permit via visas for financially independent or digital nomads: the D7 visa. Applicants confirm a monthly income of €760, get health insurance, and buy or rent a residential property in Portugal.

For a D7 visa for financially independent individuals, applicants must earn passive income through dividends, pension, interest on deposits, or rent — at least €760 per month.

For a Portugal Digital Nomad Visa, foreigners must have income from working remotely, either as freelancers or foreign company employees. Their average income over the last 3 months must be €3,040.

Where in Portugal do foreigners buy property?

Portugal is conventionally divided into 7 regions — this is a geographical division, not an administrative one. Each region has several districts or Portuguese provinces. There are 5 regions on the continental part, plus 2 islands surrounded by the Atlantic Ocean: Azores and Madeira.

The most popular destination for non-EU buyers is Algarve, a region in the south. It is also one of the best places in Portugal to invest in real estate, home to stunning resorts and holiday destinations.

In second place is the Lisbon region, including its capital and suburbs: the Setubal district with the resort towns of Cascais and Estoril. The third most popular religion among foreign buyers is the Central Region.

The most popular regions among non-EU buyers are the Algarve, Lisbon and Central regions — 8 out of 10 apartments and houses purchased by foreigners are located there.

The Lisbon, Central and Northern regions, including Oporto and Braga, lead total property sales.

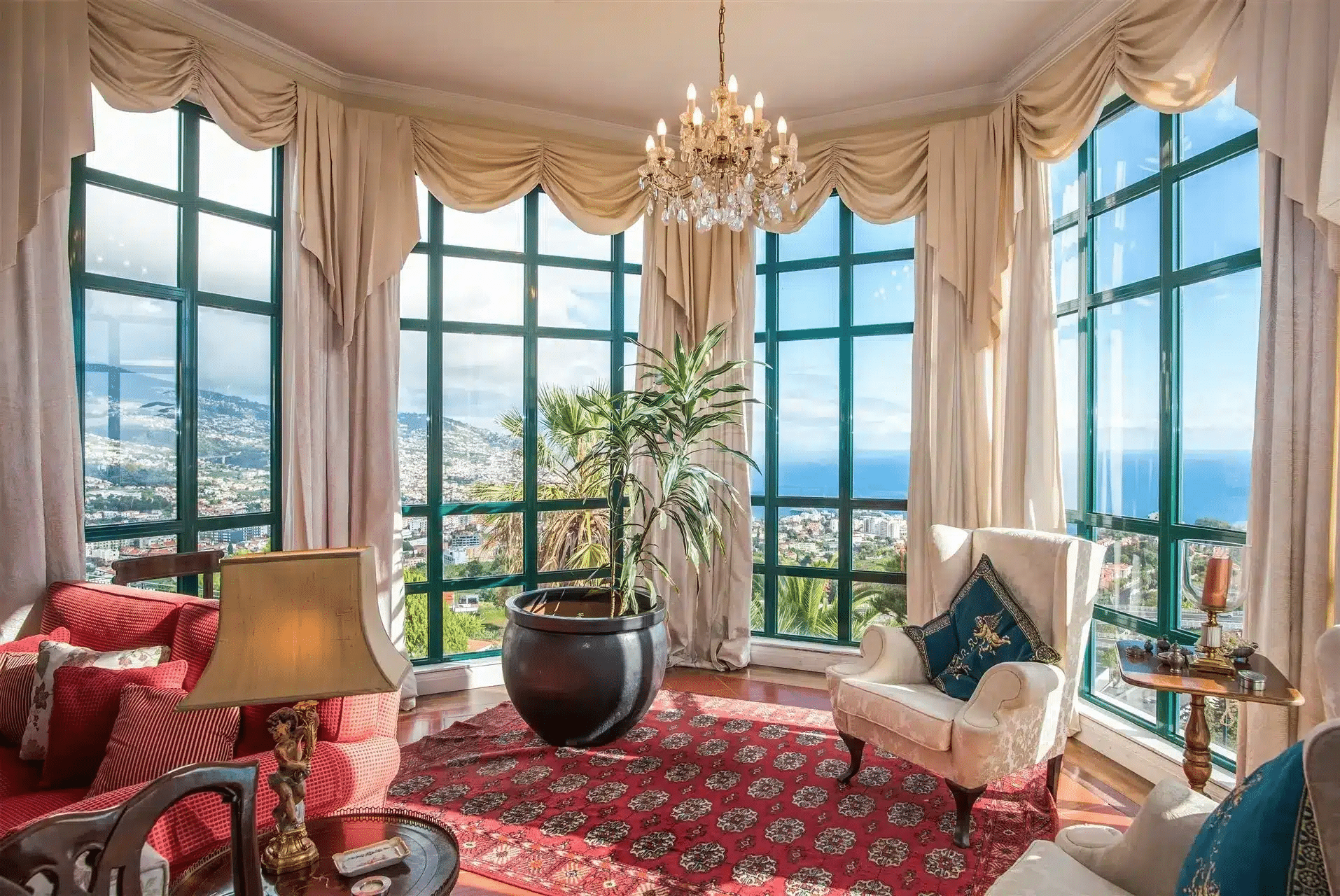

The most expensive properties are in the Algarve, Lisbon and Madeira regions — the average transaction amount there is 1.5—2.5 times higher than the national average. At the same time, rental yields are higher in the country’s interior, where property costs are lower.

The cheapest place to buy property in Portugal is Penedono, in the district of Viseu. According to idealista.com, the average price is €305 per 1 m².

Average transaction amount by region in Portugal

| Region and major cities | Average transaction amount |

| Portugal | €407,000 Foreign buyers €190,000 All buyers |

| Lisbon Region Lisbon, Cascais, Estoril | €580,000 Foreign buyers — 1st place €265,000 All buyers — 2nd place |

| Algarve Faro, Lagos, Albufeira | €488,000 Foreign buyers — 2nd place €284,000 All buyers — 1st place |

| Madeira Funchal | €358,000 Foreign buyers — 3rd place €204,000 All buyers — 3rd place |

| Alentejo Santaren, Evora, Beja | €253,000 Foreign buyers €111,000 All buyers |

| North Region Porto, Braga | €235,000 Foreign buyers €156,000 All buyers |

| Central Region Aveiro, Coimbra | €180,000 Foreign buyers €118,000 All buyers |

| Azores Islands | €157,000 Foreign buyers €143,000 All buyers |

Most of the new buildings in the Northern region are located in Porto and Braga. Almost half of all new apartments and houses in Portugal are built here. The Central and Lisbon regions come second and third regarding new buildings.

New buildings are bought 5 times less often than secondary real estate due to the higher cost and limited selection. The share of new facilities is higher in the coastal areas of Lisbon, Setubal, Porto and Faro.

Types of property in Portugal

Apartamento, andar, and Condomínio or condo are separate unit types in multiple-unit residential buildings. Apartamento is part of a residential complex owned by a single entity. Apartments are typically rented out. Condomínio is a residential complex where every unit has its separate owner. Penthouses with terraces and panoramic views fall under the condomínio type.

A residential complex can have dozens to a few apartamento or condomíno units. Outdoor spaces vary greatly: high-end complexes can have gardens, swimming pools, gyms, large playgrounds, daycare, and round-the-clock security.

Casa, or moradia, is a common, separate-standing house. Typically has a patio or a backyard and is surrounded by a wall. Residential villas also fall under this type. Rustic estates with large land areas, such as farms or vineyards, are usually called “quintas”.

Casa geminada is a semi-detached house — essentially, a duplex. Two casa geminada units are separated by a shared wall. Some may have a small outdoor space and a wall around them.

Terreno is a plot of land. Different types can be used for residential, commercial, or agricultural constructions.

All housing units in Portugal are classified using the letter “T” and a number that indicates the number of bedrooms: T1, T2, T1, and so on. T0 is given to studio units.

Real estate to buy in Portugal

Benefits of buying property in Portugal

Profitable investment. Rental yields in Portugal grow by approximately 5.5% annually. Reselling is also profitable since residential real estate prices in the country increase by 3—5% annually.

Residence eligibility. Renting or buying real estate is one of the conditions for getting a Portugal D7 visa or Digital Nomad Visa. Both visas come with a residence permit, with a chance to get citizenship for the entire family in five years.

Tax optimisation. The non-habitual resident or NHR scheme provides a special tax regime to new arrivals: they pay tax on local income at a fixed 20% rate for 10 years. Foreign income for them is taxed at a standard rate.

Education and healthcare access. Portugal has both public and private education and healthcare systems, known for their quality and availability to all residents. Local universities, such as the University of Porto, the University of Lisbon, and the University of Coimbra, are among the world’s best by reputable rankings.

Comfort, security, and stability. Portugal is expat-friendly, energetic, and safe. It has a plethora of lifestyles for everyone: big-city fans, foodies, hikers, ocean lovers, or history buffs. Natural disasters rarely occur here, and the warm temperate climate is pleasant year-round. Regarding safety, Portugal is in the Global Peace Index’s Top 10.

What to remember when buying a property in Portugal

Legal support of the transaction. Property buyers are not obligated to have solicitors. However, a lawyer helps check the legal clarity of the deed and the title.

Other common problems when buying real estate in Portugal:

- Debts on taxes and utility bills in Portugal are assigned to a property, not its owner. If the owner does not repay the debt before selling it, the buyer will be obliged to pay the debt.

- When buying a plot of land with several buildings, not all can be registered in the land cadastre: for instance, outbuildings. A lawyer assists with registering such facilities or assesses potential risks the buyer may face if they decide against registering.

- Shared ownership of real estate. When inheriting, shares can be distributed among relatives, so selling the real estate without the consent of all owners is impossible. Collecting documents for the transaction may be difficult if there are multiple shares because the owners may live in other countries.

Legal support usually costs 1% of the property transaction. All documents are written in Portuguese so buyers may need a translator.

Documents for real estate are required to verify the legal clarity of the title and its area and purpose. The seller provides these documents. They are also necessary for transaction notarization:

- Certificate of occupancy from the municipality — Licença de utilização. Specifies the purpose of a property and the basis for issuing the permit — commercial or residential real estate, new construction or reconstruction.

- Title deed — Certidão de Teor. Certifies the legal status of a property. Contains the property’s address, the history of the transfer of ownership rights, and encumbrances.

- Tax authority document — Caderneta predial. Certifies the fiscal status of a property. Includes the owner’s name, the property’s cadastral value, and other information for calculating municipal property tax.

- Technical data sheet — Ficha técnica de habitação. Contains a description of the property’s technical characteristics, such as structure, facilities, condition, and construction details. It was issued for real estate built after 2004.

- Energy efficiency certificate — Certificado enérgetico. Establishes the energy efficiency category of the property.

Bank account. Buyers do not have to open a bank account in Portugal to pay for the property. They can transfer money to the seller from outside of Portugal. In this case, buyers must issue a power of attorney to a realtor or lawyer, and the transaction will be done remotely.

Paying for utilities may require a bank account. Owners who rent out their property can ask tenants to cover the utilities: the agreement must be added to the lease and utility contracts.

A foreigner must visit a Portuguese bank in person to open an account.

Property purchase taxes and fees paid by the buyer:

- Transfer of ownership tax — up to 8% of the transaction amount. The rate depends on the property’s value, type, and purpose: for example, whether it is a main dwelling, countryside house, under-construction building, or land plot.

- State duty or stamp duty — 0.8% of the transaction amount.

- Notarization — €250.

- Registration of ownership fee — €250.

- Reassigning a utility company contract — €100.

Property maintenance costs include taxes and utility bills. The annual municipal property tax is 0.3—0.8% of the cadastral value, depending on the property type, location and construction year. An additional tax of 0.7% of the cadastral value is paid for urban real estate.

If owners rent their properties out, they pay annual rental income tax. Residents are taxed 28%, and non-residents 25%.

Utilities are approximately €110 per month for an 85 m² apartment. There is no central heating in Portugal. Houses with gas heating are rare. Water in homes is heated in electric or gas boilers.

Air conditioners and electric heaters are rarely used for heating since they add at least €100 to an average €50 electricity bill each month. Private homes are often heated with wood-burning fireplaces.

Cooking in Portugal is done on gas stoves. Central gas networks are available only in large cities. In other areas, gas is bought in bottles or tanks. Villa owners usually use the former, and apartment and condo buildings — the latter. All gas bills, except for the bottle-stored kind, are calculated via gas meters. A gas bottle costs €50 and lasts about a month for a family of four.

Owners of apartments and condos pay building maintenance bills, such as for cleaning, repairs, elevator, security, or swimming pool. A monthly bill ranges between €25 and €200.

Seller’s expenses. Real estate sellers in Portugal pay the following taxes:

- Capital gains tax — 28% of the profit from the sale, minus purchase taxes, commission, and legal support expenses. Tax is not paid when buying another property with the proceeds.

- Property sales tax — 0.4% of the value. It was paid not immediately but in the tax year following the sale.

If the property is sold through a realtor, total expenses include a commission: 3.7—6.2% with VAT.

Step-by-step procedure for buying real estate in Portugal

Buying a property in Portugal usually takes 1—2 months from the moment of selection to obtaining the certificate of ownership. If the seller does not have all the documents immediately, processing times may increase to 6 months.

Property is selected remotely from a database of verified properties. Even if buyers want to come to Portugal in person, they can choose options in advance and attend and attend online viewing.

NIF is a taxpayer number the Portuguese tax authority assigned and used for property tax payments. Foreigners without a Portugal residence permit receive NIF through a tax representative who is a citizen: for instance, a real estate lawyer.

A NIF application can be made online or in person. Applicants receive their taxpayer number by e-mail and their NIF card — by mail or at the tax office.

The preliminary agreement, or contrato de promesa compra e venda, guarantees that both parties will finalise the deal at a set price.

Depending on the seller’s conditions, the buyer deposits from 10 to 30% of the property price. If the main transaction falls through because of the buyer, the seller keeps the deposit. If it falls through because of the seller, the buyer gets twice the deposit amount.

The buyer pays a 0—8% transfer tax, depending on the value of the property and its location. The tax must be paid within 3 days before the final transaction.

The contract is signed with a notary or at the Casa Pronta Public Services centre. The list of attached documents must include the following:

- Certificate of occupancy from the municipality — Licença de utilização.

- Title deed — Certidão de Teor.

- Tax authority document — Caderneta predial.

- Technical data sheet — Ficha técnica de habitação.

- Energy efficiency certificate — Certificado enérgetico.

The buyer transfers the remaining amount to the seller and pays the state fee of 0.9% and the notary fee of €250.

The buyer registers ownership in the Portugal land cadastre and notifies the tax authority of the change of ownership. The registration fee is €250.

The buyer renegotiates the utility company contract. The contract can later be assigned to the property’s tenant, not the owner. The fee is approximately €100.

Key takeaways: investing in Portugal real estate

- Property buyers can get a Portugal residence permit — a D7 visa.

- Residential property prices in Portugal have doubled over 7 years.

- The average cost of residential property in Portugal is €190,000, and the average value of property purchased by foreigners is €406,000.

- Lisbon, Porto, Braga, and Algarve are the most popular real estate markets. Foreigners typically choose the Lisbon region and the Algarve.

- The most expensive properties are in the Algarve, Lisbon, and Madeira.

- The process of buying real estate in Portugal takes 1—2 months.

- Property buyers pay the transfer of ownership tax and state, notary and registration fees. Additional expenses are 1—10% of the transaction amount.

Frequently Asked Questions

Real estate in Portugal is a profitable asset that allows you to get a residence permit. The cost of real estate in Portugal is growing by an average of 10% per year. Rent brings in approximately 6% of the property’s value per year.

Property owners can get a Portugal residence permit if they confirm an income of at least €760 per month.

The most popular areas in Portugal for buying real estate are Lisbon with its suburbs, the Northern region with Porto and Braga, and the southern region of the Algarve. Foreigners most often choose Lisbon, Cascais, Estoril and the Algarve.

The most expensive properties are in Lisbon and the Algarve, while rental yields are higher in the interior regions with lower property values.

Property buyers pay up to 8% transfer tax and a state duty of 0.8% of the contract value. The transfer tax rate depends on the value of the property and its location.

In addition, buyers pay a notary fee and registration fee, €250 each.

Foreigners can buy property in Portugal without restrictions. Investors often choose the resort region of the Algarve, the metropolitan region of Lisbon and the Setubal district, with the resort cities of Cascais and Estoril. The average cost of buying a residential property in Portugal is approximately €190,000.

A foreigner must have lived in the country for 5 years with a residence permit to apply for Portugal citizenship. A buyer of Portuguese real estate can get a residence permit for financially independent individuals or digital nomads: the D7 visa. The cost of real estate, in this case, does not matter.

Property buyers can get a residence permit in Portugal if they confirm a monthly income of €760. Real estate can be of any value.

Until April 2023, Portugal had a residence permit program by investment, also known as the Golden Visa. The minimum investment threshold for the real estate option was €280,000.

Yes, non-European Union buyers can purchase residential real estate in Portugal. There are no restrictions or special permits imposed. The process can be remote, including selecting a title, obtaining a Portuguese tax number, collecting the documents, signing the preliminary and final agreements with the seller, and transferring ownership.

Rental income is always taxable, whether the owner is a Portugal resident or not. Residents are taxed at a flat rate of 28%, and non-residents — at 25%.